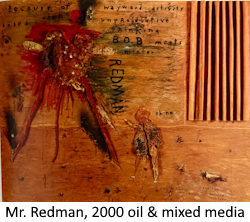

OCTOGENARIAN CELEBRITY ART

Art has been recognized as

an alternative asset class since time

immemorial. Critically acclaimed celebrity art has

established

a historical record of parabolic price appreciation upon the passing of

the celebrity artists.

At Stealth Wealth | Confidential we specialize in the curation of living octogenarian celebrity art that meets our criteria of celebrity status, provenance, and critical acclimation. Our members have access to art poised to skyrocket with the inevitable.

Celebrity high caliber art has the unique attraction of bringing to bear a certain automatic market and attention of millions of established fans.

Unlike other alternative investments which value exists as mere digital zeros and ones in a bank or brokerage computer, these investment you can enjoy on a daily basis when stored properly in your own home or office.

We carefully select pieces that we have a high degree of confidence will appreciate exponentially as their scarcity looms. We do not recommend selling or flipping these pieces. They have a long standing history of appreciating aggressively over time compared to other asset classes.

Owners should consider using these pieces as collateral if monetization becomes necessary.

Stealth Wealth | Confidential members are given access to our careful curation of meticulously researched living octogenarian art, along with our connections on where to purchase and at what recommended price range. Many of these works are priced higher than market and subject to negotiation with galleries.

We don't just uncover where these pieces are available at retail, we also crawl the web every single day to share with our members auctions and private party offerings, appropriately provenanced, that become for sale. And we research and curate other non-visual art memorabilia to provide a wide variety of pieces for a spectrum of member investor budgets.

Here are just two of the many historical instances of critically acclaimed art garnishing parabolic postmortem prices.

Case

Study No. 1:

David Bowie

Case

Study No. 1:

David Bowie

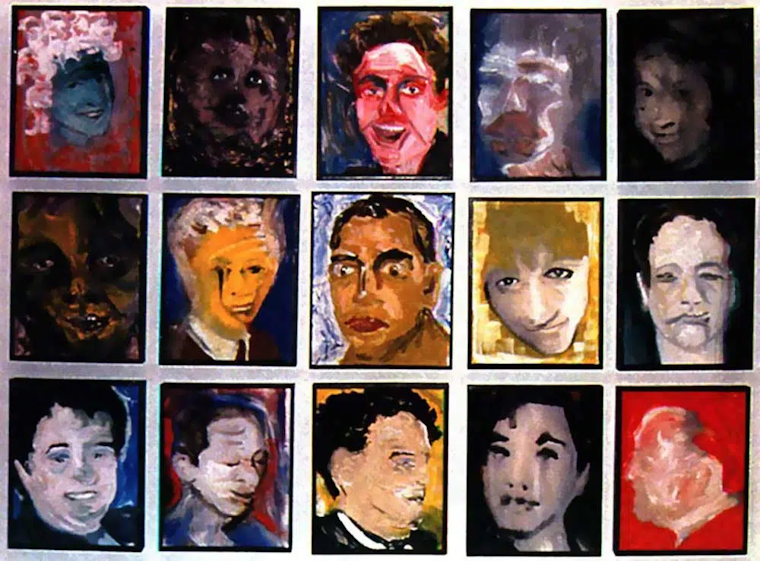

Six time Grammy Award artist David Bowie was a prolific painting artist. He left this world on January 10, 2016 at the age of 69.

One of Bowie's paintings, DHead XLVI (on right), was found and purchased in a garbage landfill in South River, North of Toronto, Canada for $5 in the summer of 2020

In June of 2021 that painting was appraised between $9,000 and $12,000, but it garnished $90,000 at an auction at Cowley Abbot Fine Art. Prior to this auction other Bowie DHead paintings commanded between $15,000 and $ 30,000 in auctions from 2016 until 2018.

Case

Study No. 2:

David Lynch

Case

Study No. 2:

David Lynch

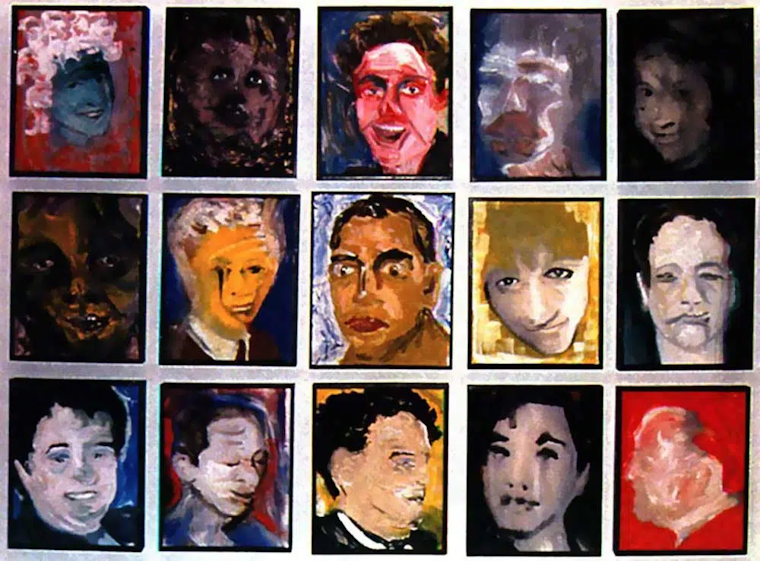

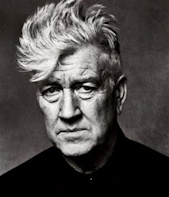

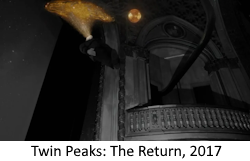

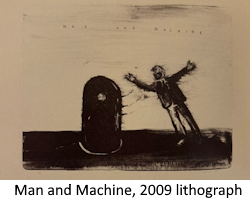

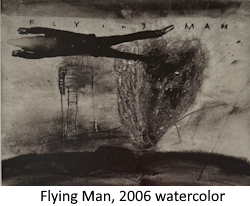

Iconic counterculture filmmaker David Lynch passed just months ago on January 16, 2025 at 78 years of age (close enough to 80s for us). Movie classics Mulholland Dr., Twin Peaks: Fire Walk With Me, Dune, and many others from this prolific filmmaker artist garnished an Honorary Academy Award, two BAFTA Awards, nine Primetime Emmy Awards, four Golden Globe awards, and a Screen Actors Guild Award.

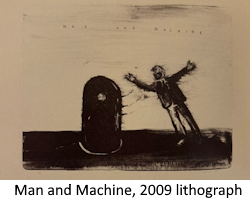

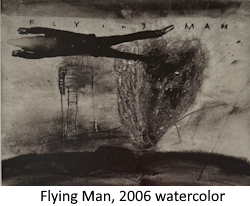

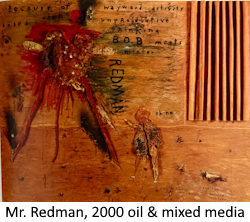

He has created an abundance of critically acclaimed art in various mediums including paintings, drawings, photography printmaking, and sculptures.

Mr. Lynch's visual art has been the subject of several retrospectives at prestigious art institutions like The Pennsylvania Academy of the Fine Arts and the Foundation Cartier.

From ChatGPT:

David Lynch was one of a select few of critically acclaimed celebrity artists with pieces curated and highlighted by Stealth Wealth | Confidential. Several of our members have become proud and highly enriched owners of Mr. Lynch's pieces in various mediums.

Case

Study No. 3: A-List Celebrity Memorabilia

We

also curate A-List elderly celebrity musicians, actors, athletes,

politicians, etc. memorabilia so that our members of all means can gain

access to this asset class.

We

also curate A-List elderly celebrity musicians, actors, athletes,

politicians, etc. memorabilia so that our members of all means can gain

access to this asset class.

ChatGPT:

"Ozzy Osbourne memorabilia has appreciated significantly since his death on July 22, 2025. Here's what the data shows:

"Sharp Jump in Collector Value - a July 2025 article from MoneyMagpie provides concrete before-and-after pricing examples, highlighting dramatic increases in value:

"High-Value Auction Listings

"Right after his passing, auction houses began offering high-profile pieces:

imagine . . .

At Stealth Wealth | Confidential we specialize in the curation of living octogenarian celebrity art that meets our criteria of celebrity status, provenance, and critical acclimation. Our members have access to art poised to skyrocket with the inevitable.

Celebrity high caliber art has the unique attraction of bringing to bear a certain automatic market and attention of millions of established fans.

Unlike other alternative investments which value exists as mere digital zeros and ones in a bank or brokerage computer, these investment you can enjoy on a daily basis when stored properly in your own home or office.

We carefully select pieces that we have a high degree of confidence will appreciate exponentially as their scarcity looms. We do not recommend selling or flipping these pieces. They have a long standing history of appreciating aggressively over time compared to other asset classes.

Owners should consider using these pieces as collateral if monetization becomes necessary.

Stealth Wealth | Confidential members are given access to our careful curation of meticulously researched living octogenarian art, along with our connections on where to purchase and at what recommended price range. Many of these works are priced higher than market and subject to negotiation with galleries.

We don't just uncover where these pieces are available at retail, we also crawl the web every single day to share with our members auctions and private party offerings, appropriately provenanced, that become for sale. And we research and curate other non-visual art memorabilia to provide a wide variety of pieces for a spectrum of member investor budgets.

Here are just two of the many historical instances of critically acclaimed art garnishing parabolic postmortem prices.

Case

Study No. 1:

David Bowie

Case

Study No. 1:

David BowieSix time Grammy Award artist David Bowie was a prolific painting artist. He left this world on January 10, 2016 at the age of 69.

One of Bowie's paintings, DHead XLVI (on right), was found and purchased in a garbage landfill in South River, North of Toronto, Canada for $5 in the summer of 2020

In June of 2021 that painting was appraised between $9,000 and $12,000, but it garnished $90,000 at an auction at Cowley Abbot Fine Art. Prior to this auction other Bowie DHead paintings commanded between $15,000 and $ 30,000 in auctions from 2016 until 2018.

David Bowie's DHead Series,

1995-1996

Want

more?

Like access to our curated, researched exclusive item catalouge of critically acclaimed, provinanced, elderly A-class celebrity art and memorabilia?

Access our prolific world-class brain trust using proprietary AI in the unique development of phenomenal alternative investment strategies.

Like access to our curated, researched exclusive item catalouge of critically acclaimed, provinanced, elderly A-class celebrity art and memorabilia?

Access our prolific world-class brain trust using proprietary AI in the unique development of phenomenal alternative investment strategies.

Case

Study No. 2:

David Lynch

Case

Study No. 2:

David Lynch Iconic counterculture filmmaker David Lynch passed just months ago on January 16, 2025 at 78 years of age (close enough to 80s for us). Movie classics Mulholland Dr., Twin Peaks: Fire Walk With Me, Dune, and many others from this prolific filmmaker artist garnished an Honorary Academy Award, two BAFTA Awards, nine Primetime Emmy Awards, four Golden Globe awards, and a Screen Actors Guild Award.

He has created an abundance of critically acclaimed art in various mediums including paintings, drawings, photography printmaking, and sculptures.

Mr. Lynch's visual art has been the subject of several retrospectives at prestigious art institutions like The Pennsylvania Academy of the Fine Arts and the Foundation Cartier.

From ChatGPT:

"David

Lynch’s

work and personal artifacts have indeed seen a remarkable surge in

value after his death in January 2025, sparking both admiration and

emotional investment from fans and collectors alike.

Market Surge: Art & Memorabilia

Personal Collection Auction

In June 2025, Julien’s Auctions held a major sale of over 450 items from Lynch’s estate, raising $4.25 million. Highlights included:

According to MutualArt, from mid‑2024 to mid‑2025, Lynch’s art realized strong results:

Market Growth: Lynch's fine art market also appears stronger now. Record prices and average realized values suggest increased interest in his visual work following his death.

In Summary

Since his death on January 16, 2025, David Lynch’s collectibles and artworks have seen a pronounced up tick in both valuation and visibility. Auction results have far outstripped expectations, and his lasting legacy continues to fuel both emotional and financial demand."

Market Surge: Art & Memorabilia

Personal Collection Auction

In June 2025, Julien’s Auctions held a major sale of over 450 items from Lynch’s estate, raising $4.25 million. Highlights included:

- Ronnie Rocket script: $195,000

- Lost Highway script: $195,000

- Director’s chair: $91,000 (est. $5–7K)

- La Marzocco espresso machine: $45,500 (est. $3K)

According to MutualArt, from mid‑2024 to mid‑2025, Lynch’s art realized strong results:

- What Did She Say (painting) sold for $75,316—far above its estimate

- Works on paper like Soft Shapes

Behind a Veil and

Sam’s Lightning sold for $11,970 and $3,668 respectively,

outperforming estimates

Market Growth: Lynch's fine art market also appears stronger now. Record prices and average realized values suggest increased interest in his visual work following his death.

In Summary

Since his death on January 16, 2025, David Lynch’s collectibles and artworks have seen a pronounced up tick in both valuation and visibility. Auction results have far outstripped expectations, and his lasting legacy continues to fuel both emotional and financial demand."

David Lynch was one of a select few of critically acclaimed celebrity artists with pieces curated and highlighted by Stealth Wealth | Confidential. Several of our members have become proud and highly enriched owners of Mr. Lynch's pieces in various mediums.

We

also curate A-List elderly celebrity musicians, actors, athletes,

politicians, etc. memorabilia so that our members of all means can gain

access to this asset class.

We

also curate A-List elderly celebrity musicians, actors, athletes,

politicians, etc. memorabilia so that our members of all means can gain

access to this asset class.Authenticated

scarce memorabilia of elderly A-list celebrities is a less affluent

investor's way of

participating in this asset class. At a fraction of what

original critically acclaimed celebrity visual art demands, investors

of any

means can procure carefully curated memorabilia pieces that are primed

to skyrocket in value upon the inevitable.

The recent departed memorabilia of rock legend Ozzy Osbourne (December 3, 1948 - July 22, 2025 - RIP) is a typical example.

Best practice is to collect several pieces. Sell off enough to break even when these items double, and keep the balance of your memorabilia portfolio for long-term appreciation.

This strategy provides cash flow to continue reasonable turnover and access to new portfolio pieces.

While these investments do not pay dividends, they do offer incredible enjoyment during ownership by displaying these unique items in your home and office.

The recent departed memorabilia of rock legend Ozzy Osbourne (December 3, 1948 - July 22, 2025 - RIP) is a typical example.

Best practice is to collect several pieces. Sell off enough to break even when these items double, and keep the balance of your memorabilia portfolio for long-term appreciation.

This strategy provides cash flow to continue reasonable turnover and access to new portfolio pieces.

While these investments do not pay dividends, they do offer incredible enjoyment during ownership by displaying these unique items in your home and office.

ChatGPT:

"Ozzy Osbourne memorabilia has appreciated significantly since his death on July 22, 2025. Here's what the data shows:

"Sharp Jump in Collector Value - a July 2025 article from MoneyMagpie provides concrete before-and-after pricing examples, highlighting dramatic increases in value:

- Black Sabbath 1970 debut LP (Vertigo swirl pressing) - Before: ~£200–£350. After: £500–£700+ for VG+/NM copies;

- Ozzy’s Blizzard of Ozz (1981 original pressing) - Before: ~£30–£50. After: £100+; sealed copies reaching ~£150;

- 1980s Black Sabbath tour T-shirts - Before: £50–£120. After: £200–£400, depending on rarity.

- Signed Ozzy memorabilia - Before:

£150–£300. After:

£500–£800+.

"High-Value Auction Listings

"Right after his passing, auction houses began offering high-profile pieces:

- A stage-worn custom black jacket from the “Retirement Sucks” tour, inscribed and autographed by Ozzy, was estimated to fetch $20,000.

- A custom mesh coat he wore in 2011 was expected to go for at least $10,000.

- A signed copy of Blizzard of Oz was expected to sell for

around $5,000.

"These amounts are well

above pre-death typical resale values, further demonstrating a

posthumous spike. Why the surge in value? This

upward trend mirrors what often happens after the death of iconic

artists—the emotional surge in demand, rarity, and cultural

reverence combine to boost prices. Collectors and fans seek

tangible connections to the late legend amid nostalgia and sentiment.

Physical items become inherently finite after their

passing—no new originals can be produced. With

Ozzy’s estate likely to manage posthumous licensing (and

possible re-releases or tributes), early originals can become

especially coveted.

"Summary

Yes, Ozzy Osbourne memorabilia has appreciated significantly since his death in July 2025. Price hikes are substantial—for both common items (like vinyl and T-shirts) and rarer, signed, or stage-worn pieces. Auctions have already showcased strong buyer interest, with six-figure pound values being realistic for standout items. Long-term outlook: scarcity and continued interest in Ozzy’s legacy suggest that rare collectibles may continue appreciating over time."

"Summary

Yes, Ozzy Osbourne memorabilia has appreciated significantly since his death in July 2025. Price hikes are substantial—for both common items (like vinyl and T-shirts) and rarer, signed, or stage-worn pieces. Auctions have already showcased strong buyer interest, with six-figure pound values being realistic for standout items. Long-term outlook: scarcity and continued interest in Ozzy’s legacy suggest that rare collectibles may continue appreciating over time."

Want

more?

Like access to our curated, researched exclusive item catalouge of critically acclaimed, provinanced, elderly A-class celebrity art and memorabilia?

Access our prolific world-class brain trust using proprietary AI in the unique development of phenomenal alternative investment strategies.

Like access to our curated, researched exclusive item catalouge of critically acclaimed, provinanced, elderly A-class celebrity art and memorabilia?

Access our prolific world-class brain trust using proprietary AI in the unique development of phenomenal alternative investment strategies.

Exponential

Wealth Compounding Through Shrewd Alternative Investing

The

exclusive portal to

shrewd alternative investments you've never

heard of designed by hedge fund trusts and family office

investment financiers

who prefer these storied gems remained obscured.

imagine . . .

- turning your secure bitcoin into a safe passive income work horse;

- gaining cost-free generational wealth by just front loading your investments through this genius insurance investment;

- scooping up stupidly discounted bonds from spooked investors selling perfectly solvent company debt into a bloody wall street;

- getting paid double-digit option premium to build your desired investment portfolio;

- acquiring critically-acclaimed octogenarian celebrity art which pieces pop on passing;

- double penetrating two double-digit returns each, from the same capital;

- participating in even-odds short-term moonshots in futures, warrants, and alternative markets designed for 10:1 asymmetric short term pops;

- saving all capital gains tax & trustee fees in business and real estate sales through a seller-appointed deferred sales trust;

-

and too much more to list it all here . . .

access

step-by-step

what, how & when to strike in our seminal monthly.

StealthWealth.Investments • copyright © 2023-25 all rights reserved.

StealthWealth.Investments and Stealth Wealth are dbas of Opes Sapientiae, LLC. TERMS | ABOUT

Reproduction in any form is prohibited without express authorization from publisher.

All material is for educational purposes only and does not constitute individualized legal or financial advice.

StealthWealth.Investments • 43 Osgood Place, San Francisco, California 94133 • e: michael[at]StealthWealth.Investments

strictly

limited to 500 investors worldwide .

StealthWealth.Investments • copyright © 2023-25 all rights reserved.

StealthWealth.Investments and Stealth Wealth are dbas of Opes Sapientiae, LLC. TERMS | ABOUT

Reproduction in any form is prohibited without express authorization from publisher.

All material is for educational purposes only and does not constitute individualized legal or financial advice.

StealthWealth.Investments • 43 Osgood Place, San Francisco, California 94133 • e: michael[at]StealthWealth.Investments